Foton AUV and Zhongtong Took China’s Bus Market by Storm

2016-08-04

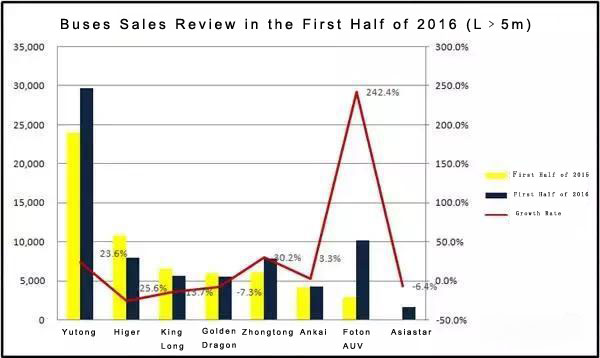

From January to June this year, China sold 105,000 units buses measuring five-meter in length and above, up by 13.7% year on year. Generally speaking, the domestic bus market was characterized by the following four features. First, Yutong continued to take the lead in the industry, witnessing a year-on-year growth of 23.6%; second, Foton AUV became the black horse in the market, surpassing Zhongtong, King Long, Golden Dragon and Higer and ranking the second place in terms of the sales volume of the buses over 5-meters in length; third, Zhongtong exceeded Higer and King Long in its sales of medium- and large-sized buses (measuring seven-meters in length) and ranked the second place.

From January to June this year, China sold 105,000 units buses measuring five-meter in length and above, up by 13.7% year on year. Generally speaking, the domestic bus market was characterized by the following four features. First, Yutong continued to take the lead in the industry, witnessing a year-on-year growth of 23.6%; second, Foton AUV became the black horse in the market, surpassing Zhongtong, King Long, Golden Dragon and Higer and ranking the second place in terms of the sales volume of the buses over 5-meters in length; third, Zhongtong exceeded Higer and King Long in its sales of medium- and large-sized buses (measuring seven-meters in length) and ranked the second place.

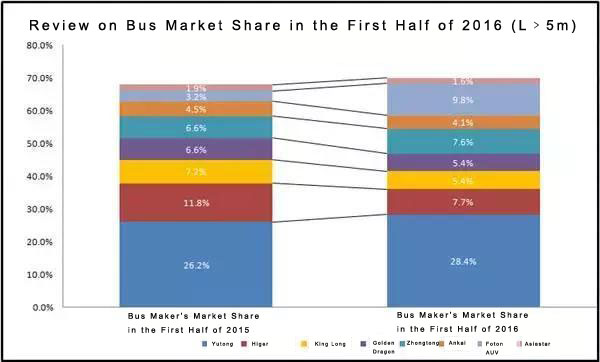

Yutong sold 2,9763 units buses measuring five-meters in length and above in the first half of this year, up by 23.6% year on year. It held 28.4% of the overall market, up by 2.3 percentage points.

Market Analysis of Buses Measuring Five-meters in Length and above in the first half of 2016.Foton AUV saw its sales grow by an impressive 242.4% year on year with a total sale volume of 10,218 units buses measuring five-meters in length and above. Thus, it rose to the second place in the industry, exceeding King Long, Golden Dragon, Higer, Zhongtong and Ankai.

In terms of the sales volume of medium- and large-sized buses measuring seven-meters in length and above, King Long, Golden Dragon, Higer and Zhongtong still hold the edge against Foton AUV, which registered a sales volume of 4,051 units medium- and large-sized buses. However, Foton AUV sold 6,167 units light buses measuring between five and seven-meters in length in the first half of this year, which made a significant contribution to its rise to the second place in the industry in the sales of buses measuring five-meters in length and above.

Zhongtong sold 7,958 units buses in the first half of this year. Its sales volume grew by 30.2% year on year, ranking the second place in the industry. After exceeding King Long at the end of 2015, Zhongtong kept a robust growing momentum in the bus market, ranking the fourth place in the industry, closely following Suzhou-based Higer. In the medium- and large-sized bus market, Zhongtong’s sales volume stood at 6,129 units, up by 63% year on year. It exceeded Higer by 632 units and ranked the second place in the market.

From January to June, Higer, King Long and Golden Dragon’s sales volume of buses measuring five-meters in length and above registered at 8,054 units, 5,691 units, and 5,616 units respectively, down by 25.6%, 13.7% and 7.3% respectively. The three bus makers’ market shares stood at 7.7%, 5.4% and 5.4% respectively.

Ankai sold 4,322 units buses in the first half of this year, up by 3.3% year on year, reversing its downward movement in this last year. Asiastar saw its sales down by 6.4% year on year in the first six months this year while it grew by 4.9% year on year last year.

Market Analysis of the Large-sized Buses in the first half of 2016.

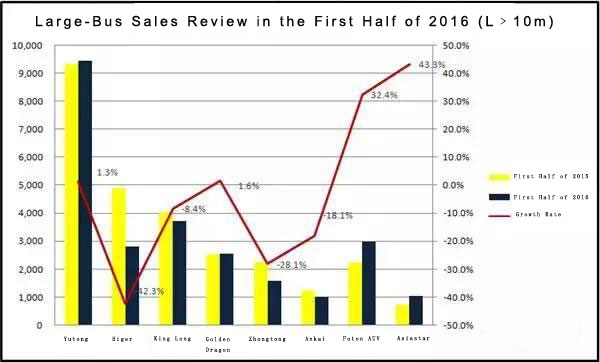

Statistics show that the combined sales volume of large-sized buses measuring 10-meters in length and above stood at 30,835 units, down by 7% year on year. Specifically, the sales volume of large-sized coaches and large-sized city buses registered at 17,663 units and 12,877 units respectively.

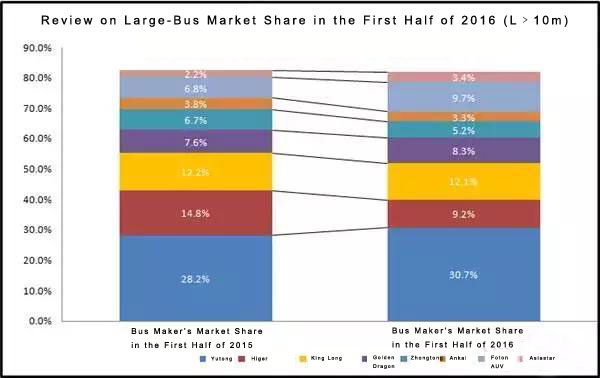

Despite the lackluster market conditions, some bus makers still succeeded in delivering impressive performances. Yutong sold 9,463 units buses in the first six months of this year, up by 1.3% year on year. It took 30.7% of the whole market, way ahead of its rivals. In the meantime, Yutong sold 7,087 units large-sized coaches with a whopping market share of 40.1%. As the large-sized coaches and buses are the main contributor to a bus maker’s profits, the robust growth of Yutong’s sales of large-sized coaches and buses has ensured the continued growth of its profits.

In the first half of this year, Foton AUV grew the fastest in China with a sales volume of 2,997 units large-sized buses and coaches and a year-on-year growth rate of 43.3%. Last year, it ranked the fifth place. However, it rose to the third place this year. The sales volume of Foton AUV’s large-sized coaches and city buses stood at 1,500 units and 1,497 units respectively.

Also worth noticing is BYD which registered a sales volume of 2,897 units large-sized buses, all of which are for urban public transportation. It ranked the fourth place in the market in its sales volume, only 100 units less than that of Foton AUV.

In the first half of this year, King Long, Higer and Golden Dragon’s sales volume of large-sized buses stood at 3,718 units, 2,824 units and 2,574 units respectively, up by -8.4%, -42.3% and 1.6% respectively. The three bus makers’ market share reached 12.1%, 9.2% and 8.3% respectively. In addition, Asiastar, with a sales volume of 1,056 units large-sized buses, edged to the top tier of the market by witnessing a whopping 43.3% year-on-year growth.

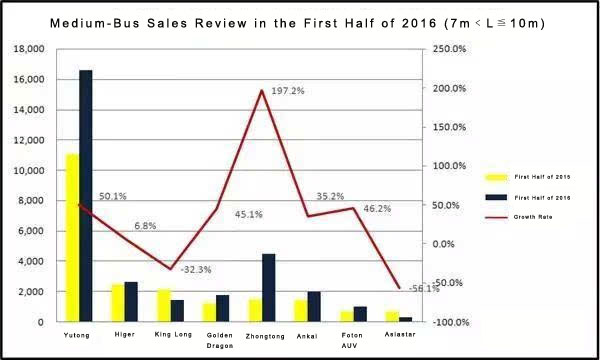

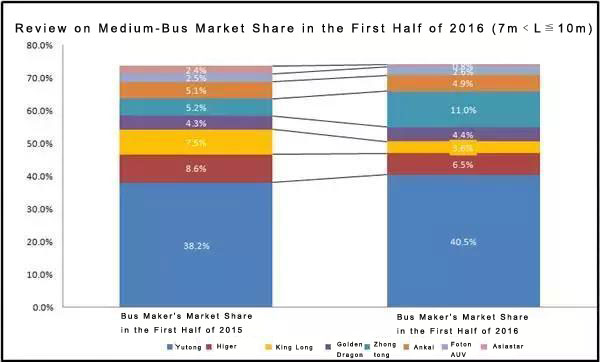

Market Analysis of Medium-sized Buses in the first half of 2016

In the first six months of 2016, China registered a sales volume of 40,988 units medium-sized buses measuring between seven and ten meters in length, up by 41.3% year on year. The sales volume of medium-sized buses took 32.7% of the overall sales of buses in China, exceeding the market share held by large-sized buses. This shows that medium-sized buses are playing an increasingly important role in the market.

Among the players in the medium-sized bus market in China, Yutong still took the lead in the market in the first half of this year with a sales volume of 16,612 units buses, which was 50.1% more than that registered in the same period last year. Its market share reached 40.5%. In addition, Yutong boasts the most competitive product line in the medium-sized bus market. In the first six months of this year, its sales volume of medium-sized coaches stood at 7,576 units, accounting for 43.3% of the market.

Zhongtong’s sales volume of medium-sized buses soared by 197.2% year on year, reaching 4,520 units in the first half of this year and growing the fastest among all the players in the market. The sales volume of the company’s medium-sized coaches and medium-sized city buses stood at 507 units and 3,927 units respectively. Thanks to its explosive growth in the medium-sized market, Zhongtong’s sales volume of large- and medium-sized buses and coaches stood at 6,129 units, up by 63% year on year. It also surpassed Higer for the first time in the large- and medium-sized bus and coach market.

In the first half of this year, King Long, Higer and Golden Dragon’s sales volume of medium-sized coaches stood at 1,471 units, 2,673 units and 1,791 units respectively. Their market share reached 3.6%, 6.5% and 4.4% respectively.

Foton AUV also delivered a good performance with a sales volume of 1,054 units medium-sized buses, up by 46.2% year on year. Its sales volume of medium-sized coaches and medium-sized city buses stood at 536 units and 497 units respectively.

In all, China’s bus market witnessed dramatic changes in the first half of this year. Zhongtong, Foton AUV, and BYD are becoming increasingly formidable in the market, especially in the large- and medium-sized bus market, ready to reshuffle the market once held by Yutong, King Long, Higer, and Golden Dragon.